Financial accounting

ITISeasy Financial accounting

Especially the finance section of the community version of odoo has been reduced again and again at the expense of the Enterprise version. However, odoo Enterprise also lacks some important functions for German accounting. In ITISeasy.business, we have therefore enriched a variety of options and functions.

Accounting and Fibu

Enhancements to the financial solution in ITISeasy.business

ITISeasy.business contains many extensions that you need for your daily work in financial accounting. Among other things, this includes a Dunning, the possibility of a DATEV-Exports, the import of MT940 Files for your bank imports and much more. Below we present you a small selection of additional extensions.

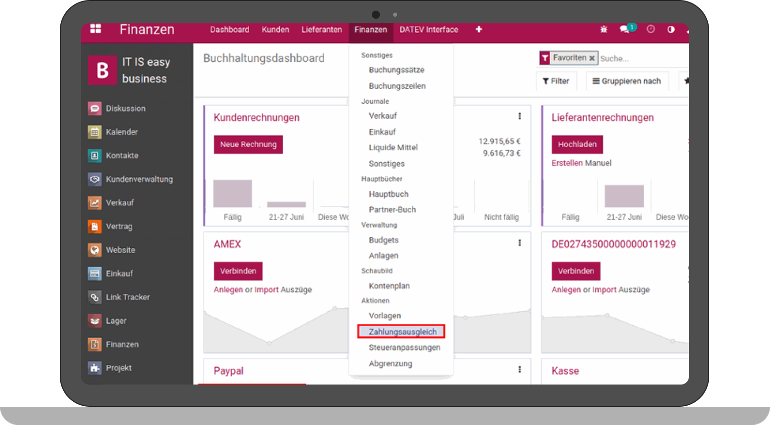

Compensation of payments

One of the negative surprises in V14 was certainly the removal of the payment settlement feature from the odoo community. This function was transferred from odoo to the Enterprise version. Of course, we have restored this functionality in ITISeasy.business

You can thus call up payments via various areas and thus reconcile your created bank statements with the existing bookings from the system.

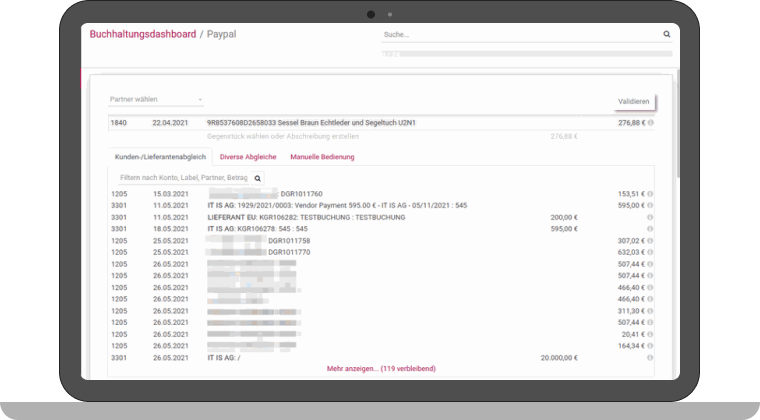

Default view for payment settlement

The display of the transactions to be cleared, with automatic suggestions based on the payment data included, make clearing simple and fast.

In our opinion, an essential functionality and therefore also a must in an ERP solution.

ITISeasy.business - the complete solution for your business

Contact us with any questions or for a demo.

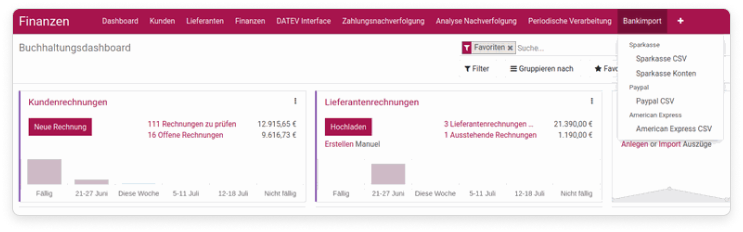

Import Paypal, AMEX

In addition to the MT940 bank import, we have also created additional import options that allow, for example, to import csv files from the savings bank, or even payment movements from Paypal and AMEX.

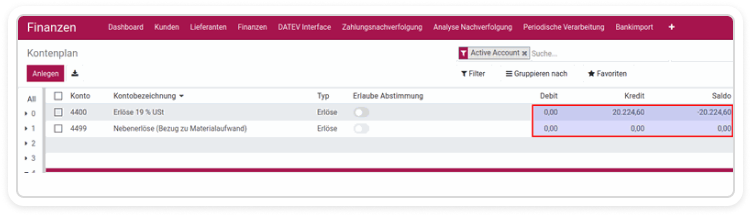

Account overview

Account balances and chart of accounts

Trial balance - fixed assets schedule - advance VAT return

Report enhancements for German accounting

Trial Balance Reports

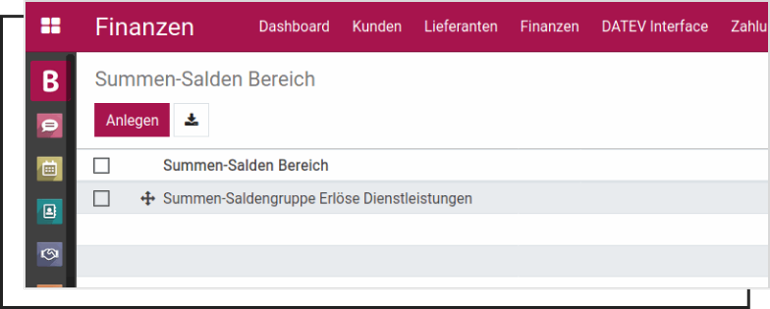

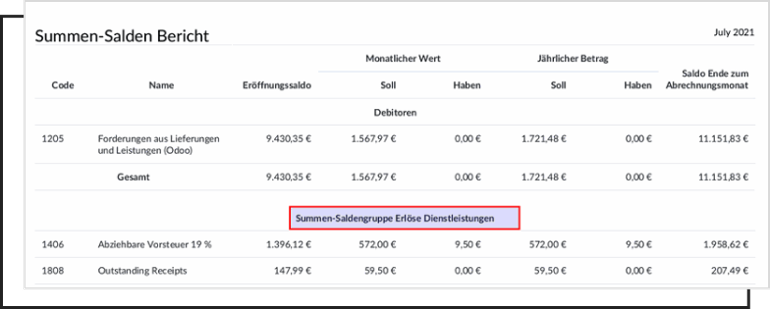

With ITISeasy.business, you can define your own totals-balance areas, which you can assign to corresponding accounts and thus create your own individual evaluation on totals and balances.

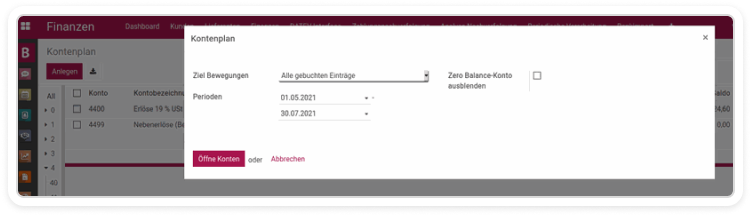

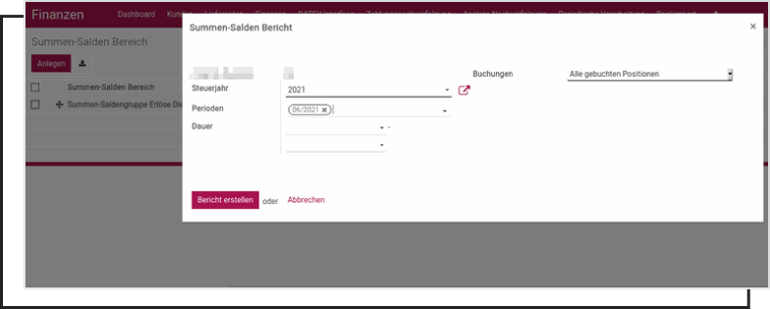

Call report for totals balances

You can generate the totals-balances report according to various criteria such as tax year, periods or individual periods. Furthermore, you can decide whether only posted amounts should be included, or also postings in the draft. This way you have full control.

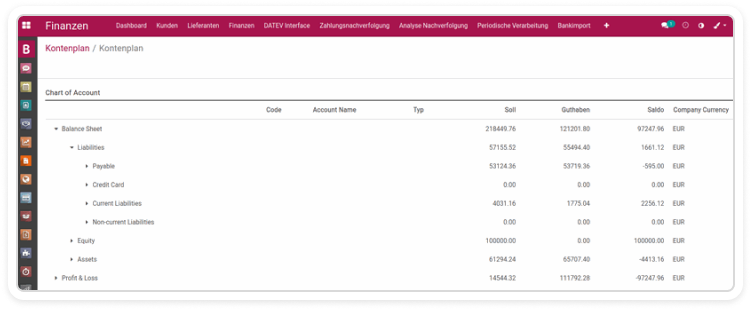

Specific representation

The totals-balance areas you create are displayed in the evaluation with the accounts you have configured. Of course, there is already a pre-configuration that allows an evaluation by account types, without your intervention.

Discover the added value of the solution compared to odoo Community / Enterprise

Contact us with any questions or for a demo.

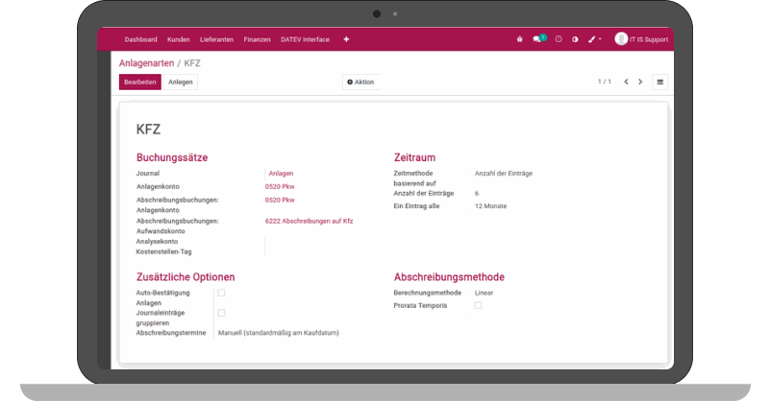

Define plant category

The asset types can be configured freely. Here you can define which accounts are addressed, how long the depreciation should run and which depreciation type you want to apply.

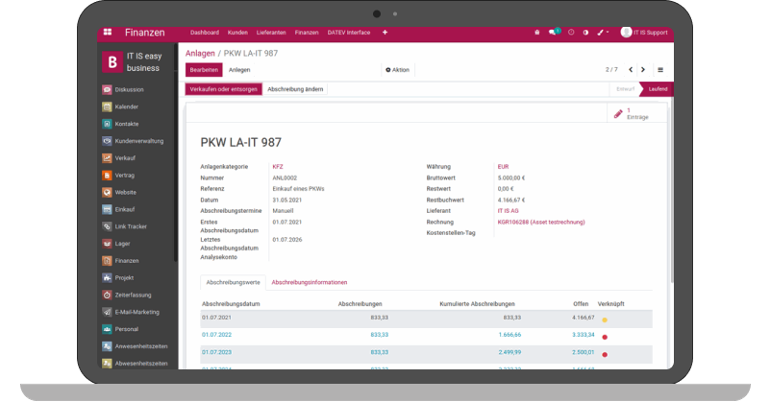

Depreciation

The assets themselves are then assigned to the categories and enriched with the values and data of the respective asset. Depreciation is calculated automatically by ITISeasy.business and created as a draft posting.

If desired, the postings can also be confirmed directly by the system. The assets can also be assigned to cost centers or, if necessary, distributed to cost centers.

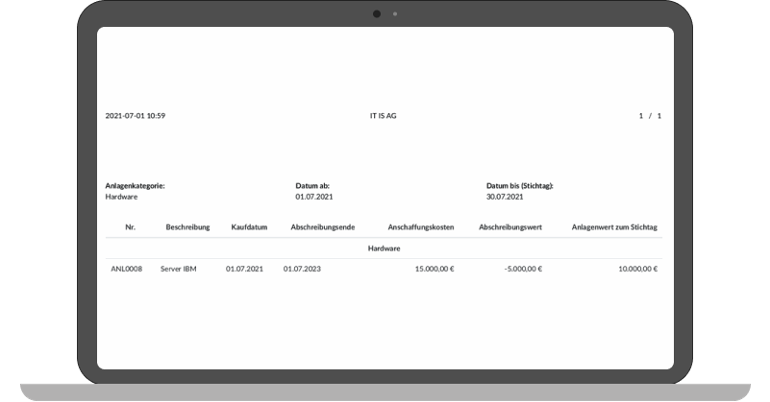

Assets analysis in ITISeasy.business

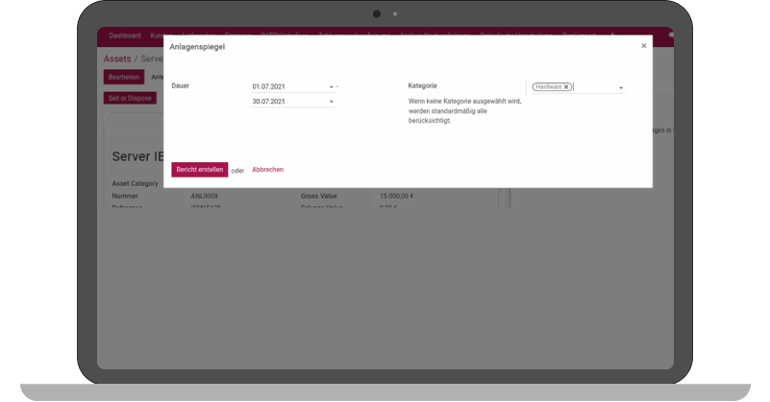

You won't find an asset history sheet in odoo's standard version. Not so in ITISeasy.business. You can define the desired time period and decide for which asset category you want to create a report. For all of them? No problem either... ITISeasy.

Assets analysis as pdf

You receive the asset history sheet as a pdf report with the typical values that your tax advisor wants from you. Directly from the system, without any manual up- / rework by your employees.

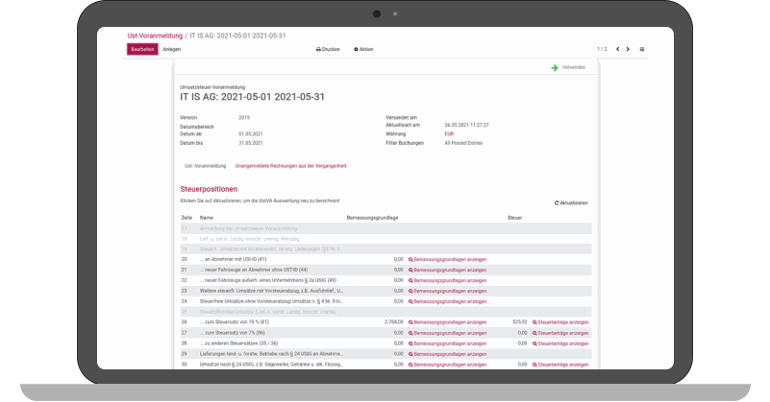

Advance turnover tax return

This is also a function that is indispensable for mapping financial accounting in Germany. The advance return for sales tax is not only visually based on the report known from Elster, but is also completely configurable, so that individual tax accounts also appear in the correct division and the report can be created automatically based on your transactions in the system.

Start now with ITISeasy.business.

Click here to go to the store - configure your solution today.